Pay from the Mobile Ports Explore Spend by Mobile phone Bill in order to Deposit and you may Play Harbors

Blogs

These restrictions will likely be in pokiesmoky.com official website accordance with the sort of account, your own put background, the length of time the newest membership could have been open and other things having your own banking matchmaking. Such, it’s you can to be targeted having a remote put capture con, for which you’lso are questioned in order to put a phony take a look at. Fortunately, you could potentially cover oneself from this kind of cellular deposit view con by the simply acknowledging paper checks away from people you understand and you can trust. The fresh Look at Cleaning to the 21st 100 years Act allows banking institutions so you can take on replacement cellular deposit monitors once they’re also the newest courtroom equivalent of a physical take a look at. That’s just what remote put get lets—the newest replacing from an electronic kind of the look for a paper one to. You might have to spend a small fee for money buy — often below $2 — to possess a worth of around $1,100.

Simple tips to establish direct put

All facts, as well as membership and you can navigation quantity, is going to be obviously noticeable regarding the photo. Private, company and you will bodies checks are generally recognized to possess mobile deposit. Other commission versions, such money orders or around the world checks, may possibly not be approved to have cellular put at the lender. Simultaneously, an over-all demands away from extremely financial institutions is the fact that the view shouldn’t be much more than just six months old. If your most recent account doesn’t give this particular aspect, it could be worth contrasting checking membership to locate one which has mobile view put or other helpful digital financial has. Cellular put is just one of the ways that financial is obviously growing.

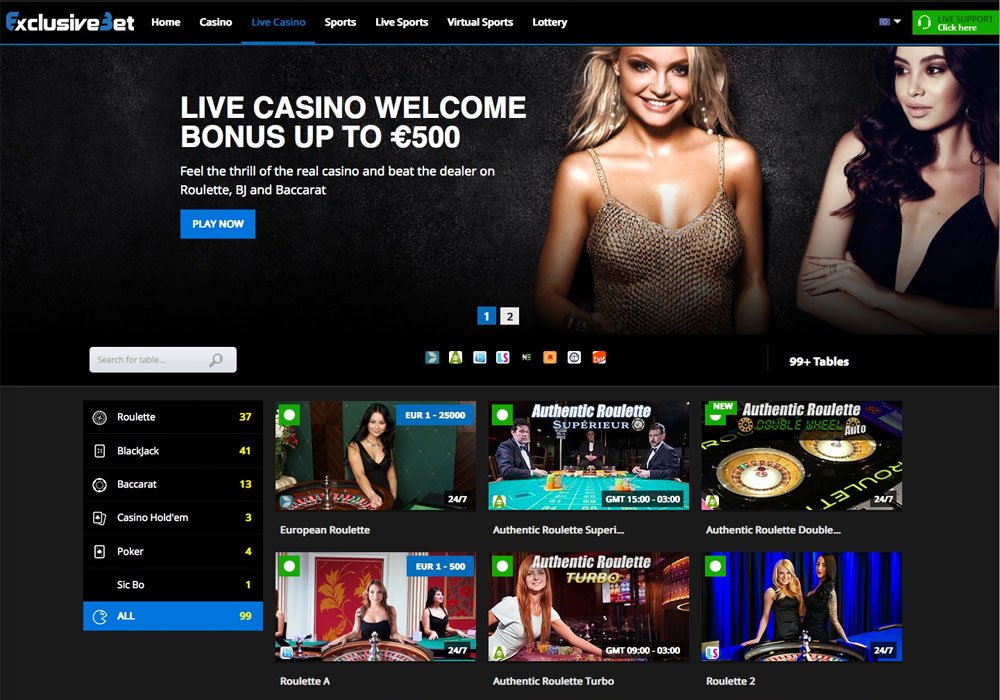

Pay Because of the Cellular telephone Costs Cellular Casino games You could potentially Gamble

We discover a joint venture partner commission from the once you click the hook up. This reality will not apply at the article conditions nor all of our unbiasedness when it comes to our very own recommendations and you may content. Even as we aren’t aware of any network team you to definitely restrict the application of fee intermediaries such as Boku, there might be particular that do. Most other tips are merely as simple, but you may need to check in a merchant account. Lower than i look at the a method to choose which method is right for you. Little stop you against altering anywhere between different methods once you have to.

As to why Have fun with Pay by the Cellular telephone at the Casinos on the internet?

Links to many other websites located on the PrimeWay Federal Borrowing from the bank Connection webpages are provided to assist in finding guidance. Know that privacy and you will shelter regulations can vary because of these skilled because of the PrimeWay Government Borrowing Connection. If you want to replace your preference any moment, only tap Change printing mode for the Receipt Options monitor while in the your own Atm consider put deal. When bringing cash at the a financial of America Atm, there will be the ability to favor exactly what bill brands you would like for your withdrawal.

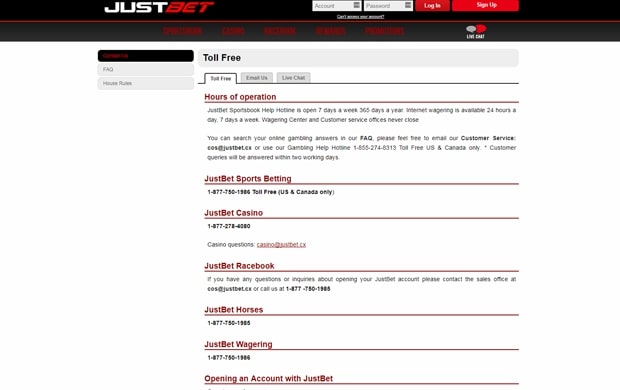

Some other commission steps, such as borrowing/debit cards, also provide 100 percent free transactions, but someone else, including PayPal, Neteller and Skrill, all have charges connected with their have fun with. Thus, if you’d like to save as often money that you can for playing games during the mobile harbors web sites, the new pay by smartphone choice will be the prime alternatives. ² To apply for Borrowing Creator, you’ll want obtained just one qualifying head put away from $200 or maybe more to your Chime Checking account. The new qualifying head deposit have to be from your own workplace, payroll vendor, concert discount payer, otherwise pros payer from the Automated Cleaning Household (ACH) deposit Or Unique Credit Transaction (OCT). Boku the most respected brands on the on line local casino industry that is typically the most popular for bringing as well as legitimate dumps which have cellular telephone expenses. Once you deposit using this type of commission strategy, it could be placed into their mobile phone costs repayments without debit card is required.

For many who’ve made several tries to put bad checks, the financial get reduce your mobile deposit restrict and you may force you to see a department otherwise an atm. The newest Wells Fargo cellular take a look at deposit restriction for all users try $dos,five hundred each day and you can $5,one hundred thousand over a great 30-time period. The newest Chase mobile consider deposit limitation for everyone consumers is actually $dos,one hundred thousand per day and you can $5,one hundred thousand more than a good 30-go out several months.

¹ Out-of-network Automatic teller machine withdrawal and over-the-prevent progress charges can get apply. A lot of things is also dictate the fresh clearness of the look at as you examine it. Earliest, ensure that you’re also delivering a photograph of your own check in a proper-lit area, and get away from nights light. 2nd, make an effort to easily fit into as much of one’s check into their physical stature because you check each party. Affect harvesting aside one an element of the consider may cause discrepancies because’s being canned. Definitely aesthetically take the digits, site, and you may pub rules expose in your view.

He’s accomplished the education demands in the University of Tx to help you qualify for a certified Financial Coordinator qualification, and you can earned a good Yards.A great. Regarding the Craig Newmark Graduate University from News media from the Town School of brand new York where the guy focused on business reporting and you will are given the fresh Frederic Wiegold Award to have Company News media. He made their student degree from Ny University, and you may partnered their college or university sweetheart which have whom he raises about three babies in the Dripping Springs, Texas.

Breeze a picture out of an excellent cheque with your phone in the fresh ATB Company Cellular and you may deposit it quickly, when, anyplace. Playing with ATB Cellular Team Banking, you might put your cheques by taking an image with your cellular telephone. Click less than in order to agree to the above otherwise make granular alternatives. You can improve your settings when, as well as withdrawing your consent, utilizing the toggles to the Cookie Policy, or from the clicking on the newest perform concur switch towards the bottom of your display. He’s got lots of experience in betting online and is pretty effective during the it.

Yet not, you could control your gambling enterprise paying by the examining your own cellular telephone membership otherwise your transaction records during the on-line casino. Needless to say, the brand new casinos to your our number is to enable you to generate payments playing with pay from the cellular telephone bill choices. The procedure might be basic allows you to establish the new percentage from the Texting.

Because the money are set on how to access, you’ll see the put reflected on your offered equilibrium. And you will associated financial institutions, Participants FDIC and entirely possessed subsidiaries from Bank away from America Corporation. When you are requested becoming Telmate Verified it means their business demands confirmation of the name ahead of greeting away from an enthusiastic inmate’s calls.

Bankrate features partnerships which have issuers as well as, although not limited by, Western Share, Lender of America, Funding One, Chase, Citi and see.

To accomplish online money, your usually you need usage of a card/cards or checking account that have on line financial. Go into pay by cellular telephone, an occurrence you to definitely efforts on the internet repayments instead of demanding a charge card otherwise family savings. Spend from the cellular phone, while the term suggests, spends your phone number to let payments which might be paid otherwise debited on the equilibrium on the matter. One of the primary downsides to presenting shell out from the cell phone statement would be the fact it only encourages instant dumps. An educated Canadian shell out from the cell phone online casinos assistance a vast directory of prompt, secure, and you may smoother detachment choices.

Keep in mind that banking companies might have some other cellular deposit limits according to your account history and you may relationship with the financial institution. The limitations is almost certainly not just like the brand new limitations to the somebody’s membership. As well, financial institutions can get (and have) altered the cellular put rules occasionally. Just last year I became able to deposit 2450 all 2 weeks thru cellular application. My handicap restarted once 6 months of being right back at the office and that i visited my mobile put and you can are struggling to get it done now. We visit your comments away from two years before, they just altered this current year.

Regulations out of deposits is generally distinctive from one to lodge to some other. As the resort protection places performs such as an excellent “prepayment”, very hotels get resorts dumps because the a hold on their website visitors’ credit cards. As a result the fresh visitor’s borrowing limit might possibly be quicker from the put matter.