Ultimate Guide to Forex Trading Training for Beginners

Forex trading is an exciting and potentially profitable venture for those who take the time to understand it. To embark on this journey, engaging in thorough forex trading training Brokers Argentina training can provide the necessary foundation. In this comprehensive guide, we will delve into the key elements of forex trading training, helping you to develop your skills and strategies for greater success on the forex market.

What is Forex Trading?

Forex trading, also known as foreign exchange trading or currency trading, involves the buying and selling of currencies in the foreign exchange market. Forex operates on a global scale, with millions of traders participating each day, exchanging various currencies for a profit. Given the volatility and complexity of the forex market, beginners must invest time in learning its intricacies before diving in.

Importance of Training in Forex Trading

Forex trading training is crucial for several reasons:

- Understanding Market Fundamentals: Aspiring traders need to understand how the forex market works, including currency pairs, quotes, pips, and spreads.

- Developing Trading Strategies: Proper training equips traders with the skills to develop effective trading strategies based on market analysis.

- Risk Management: Knowledge of how to manage risk is essential for protecting capital and minimizing losses.

- Building Confidence: Training enhances a trader’s confidence by providing them with the necessary knowledge and practical skills.

Types of Forex Trading Education

When it comes to forex trading training, there are numerous resources available, including:

Online Courses

Numerous educational institutions and online platforms offer comprehensive forex trading courses. These courses often cover a wide range of topics from basic to advanced trading strategies.

YouTube Tutorials

YouTube is a treasure trove of videos created by experienced traders and educators. These videos can provide insights into real-time trading, technical analysis, and market updates.

Books and eBooks

Several established authors have written books focusing on forex trading strategies, chart patterns, psychology, and risk management. These resources can serve as excellent reference materials.

Webinars and Live Sessions

Participating in live webinars allows traders to learn from market professionals, ask questions in real-time, and get feedback on their trading decisions.

Key Concepts in Forex Trading

Successful forex trading involves understanding several key concepts:

Currencies and Currency Pairs

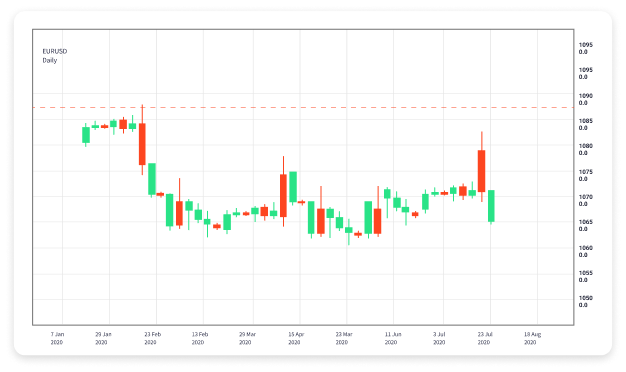

Forex trading focuses on currency pairs, which represent the value of one currency against another. Major pairs include EUR/USD, GBP/USD, and USD/JPY.

Pips and Lots

A pip is a standardized unit that measures the change in value between two currencies. Trades are executed in lots, which represent the size of a trade.

Leverage and Margin

Leverage allows traders to control a larger position with a smaller amount of capital. Understanding how leverage affects the potential for both gains and losses is essential.

Technical and Fundamental Analysis

Successful traders analyze market conditions through technical analysis (charts and indicators) and fundamental analysis (economic news and reports).

Developing a Trading Plan

A trading plan is essential for any trader, as it provides a clear roadmap of goals, strategies, and risk management techniques. Elements of a trading plan typically include:

- Trading Goals: Define short-term and long-term goals.

- Market Analysis: Indicate how you will analyze the markets (technical vs. fundamental).

- Risk Management: Specify risk tolerance and position sizing.

- Exit Strategy: Outline when to exit a trade for both profit and loss situations.

Practicing with a Demo Account

Before investing real money, most forex training programs recommend starting with a demo account. A demo account allows traders to practice their strategies in a simulated environment without risking any capital. This is invaluable for:

- Gaining experience in executing trades.

- Trying out different trading platforms.

- Testing strategies without financial risk.

Staying Informed and Continuous Learning

The forex market is constantly evolving, which means traders must stay informed about market changes, economic reports, and global events. Continuous learning is key. Some ways to stay updated include:

- Reading financial news websites.

- Following economic calendars for key data releases.

- Participating in trading forums and communities.

- Joining social media groups specific to forex trading.

Conclusion

Embarking on your forex trading journey requires education, dedication, and a willingness to continuously learn. By engaging in comprehensive forex trading training and employing the right strategies, you can increase your chances of achieving success in the forex market. Remember, informed trading decisions are the key to profitability!